Wednesday, December 30, 2009

CIMB to sell 65 properties to EPF for RM302m

The group, in an announcement yesterday, said the sale will raise cash for CIMB Bank's working capital, reduce its risk-weighted assets by the book value of the properties and reduce its property risks.

Tuesday, December 29, 2009

Property stocks rally

High end condo developers:

E & O (sell beyond RM1.06), IJM Land (sell beyond RM2.36)

Commercial developers: Glomac (sell beyond RM1.36)

Buy back on price consolidation.

Tuesday, December 22, 2009

2010 Property Market Grim ???

The housing market has seen asking prices peaking in Dec 2009 but I see dampening prices in next few months into 2010 when the recently announced real property gain tax kicks in. The growth rate of new buyers enquiry will slow, prompting developers to step up their efforts in showcasing their offerings.

Other factors pointing to a slowdown in property market will be rising mortgage rates by banks and cancellation of the interest absorption scheme by developers. Rates increase will means higher repayment on mortgages on both existing lenders and dampened speculative/investment sentiment of new lenders. Some will be able to handle the rising rate. The ones that won't be able, may rush to dump their existing property on the secondary market, adding to the already high inventories level.

What will happen to the property prices then....? And the property counter share prices then...?

Monday, December 21, 2009

E&O sells land adjacent to St. Mary

The company is confident the new owner would continue to appreciate and uphold the planned concept for the 4,700 square metre land which was earlier slated to be developed into a 35-storey commercial tower. The tower, when combined with the St Mary development, is expected to create an integrated commercial development, resulting in the enhanced value of both properties in the Kuala Lumpur business district.

YTL and PDC to build in Penang

Originally, a hotel was to be built on the site by PDC Heritage Hotel Sdn Bhd, a joint venture between YTL Hotels & Properties Sdn Bhd (a wholly-owned subsidiary of YTL Corporation Bhd) and PDC. After the hotel project was shelved due to the economic slowdown, PDC Heritage Hotel sought to change the type of development from hotel to luxury apartment.

Subsequently, it applied to change the type of land holding to freehold and the condition of land use to residential and business.The new project comprises three six-storey 76-unit apartment blocks including an underground basement, a clubhouse and a restaurant.

Saturday, December 19, 2009

Of Bridals and Evening Dresses

Tuesday, December 15, 2009

Tips on how to choose unit trust funds

UNIT trust funds offer an attractive alternative to retail investors, especially those looking for the benefit of diversification with a small pool of capital while enjoying the possibility of earning higher returns compared with conventional savings.

However, a lot of people have the misconception that the diversification nature of these funds means that the risk of investing in unit trust is low and they can just close their eyes and simply pick any of the funds that come along.

This misconception has led to many paying high prices in learning that as in any type of investments, investing in unit trust funds requires some basic understanding and research before we commit our hard earned money to it.

In general, we can classify the unit trust funds in the market into two major categories: income funds and growth funds. By Mr Ooi Kok Hwa in StarBiz, see full writeup here, http://biz.thestar.com.my/news/story.asp?file=/2009/12/16/business/5308178&sec=business

Tuesday, December 8, 2009

Real estate investors pick China over Singapore

The report put the Republic in fifth place in the latest rankings of Asia-Pacific cities with the best property investment prospects. It came in second the last time.

The top three cities, overtaking Singapore in the investment league table, are Shanghai, Hong Kong and Beijing respectively, with Seoul in fourth place.

Choo Eng Beng, PwC’s assurance real estate leader, said the results came as no surprise in the light of the remarkable resilience of the Chinese economy.

And Stephen Blank, senior research fellow of finance at the Urban Land Institute, said Singapore’s drop should be put into context, given that the difference between the third, fourth and fifth places was minor.

About 270 industry experts from across the region — including investors, developers, property companies, lenders, brokers and consultants — were questioned about their views on the outlook of the property sector for the survey.

Concern about an oversupply of property in Singapore over the next two years dented the city’s ranking among developers. Experts placed Singapore 11th, compared with seventh last year.

Respondents seemed most bullish about investment prospects for the residential property sector here, whereas other categories, such as retail and office, were placed in the “hold” category.

Saturday, November 28, 2009

U.S. Hotel owners behind on payments

But all that discounting hasn't stopped occupancy from dropping an average of 10 percent. The result? Hotel loans have begun falling into delinquency faster than any other kind of commercial real estate debt.

The rising defaults paint a grim picture for an industry with increasingly more rooms than guests, and more hotels still opening every day. It's a problem that could get worse before it gets better, with demand expected to remain weak and ambitious new projects planned before the meltdown worsening the room glut.

The oversupply means room rates should stay low for at least another year, good news for consumers but not so great for hotel owners and the banks that lent them the cash to build or buy.

The rise in delinquencies is sharp. Five times more hotel loans are behind on payments this year than in 2008, according to mortgage data firm Trepp LLC, which tracks those traded by investors. In October, 8.7 percent were distressed, compared with 1.5 percent last year.

Wednesday, November 18, 2009

Rally's Low Volume Prompts Question: Whither Buyers?

November is just half way over and already the markets are worrying about December.

The theory, among stock traders and others, is that some investors have had such a good year that they are ready to shut the books and sit it out until 2010, creating a liquidity vacuum.

"There's somewhat of a debate...There is a concern about liquidity drying up in a meaningful way in December, but that is yet to be seen," said Morgan Stanley chief U.S. credit strategist Greg Peters. "There's a concern from bankers and syndicate folks that if you want to bring a deal you have to bring it soon."

For that reason, there's been a flood of corporate debt issuance this week, totalling $17 billion in investment grade in just two days. More deals are expected through the end of the week. Also on tap for markets Wednesday are the consumer price index, as well as housing starts and building permits, all at 8:30 a.m.

Tuesday's markets were fairly quiet. The so-called "risk trade" was out of whack, as the dollar rose, commodities rose, bonds rose and stocks rose slightly. Typically, the dollar trades countertrend to the risk assets, like stocks and commodities.

Whither Buyers?

The low volume nature of the nearly 8-month old market rally has been an ongoing concern, but now the absence of institutional players could be an issue.

Jack Ablin, CIO of Harris Private Bank, said he watches the action in the last half hour of trading for clues about the market, and he is getting concerned. "It used to be we lose ground in the morning and rally back in the afternoon. Now it seems we're losing steam in the last half hour. That's the time usually reserved for institutions," he said.

"It looks like a lot of the thrust form the biggest players is beginning to wane. The good news is because values are full, we're not stretched, it's not a bubble. I think there's enough support around the edges. That's why if we had anything, it would be a 10 percent correction at most, and an opporutnity for those on the sidelines to get back in," he said.

Morgan Stanley's Peters said there's a feeling that some funds could just sit out for a while. "My sense is liquidity will be choked down, but what I think you'll actually see is an up move. I think it could lend itself to a down trade or an up trade, but I think the tendency this time around will be an up trade, which is why you're seeing on the equities side, people start to traffic in the large caps and also a lot of options trades as well. It tells you liquidity is a concern, and they're also worried about a powerful move to the upside," he said.

Ablin said if there is a correction, it would most likely be early in the year. One of his favorite indicators is flashing a warning -- the Smart Money index, which subtracts the S&P 's move in the first half hour of trading from its movement in the last half hour of trading. The first half hour is mostly influenced by order flow from retail investors, while the last half hour is when institutions are active.

He said the index bottomed in October, 2008, and it is now beginning to weaken.

"I don't think we're in a bubble, but I would start to get a little more squeamish if this market goes up a lot.. We may have to wait until after year end. (for a correction) We actually could sees a little pop of upsurge at year end as some of these mutual fund mangers throw in the towel and square in positions for year end," he said. "Maybe they do a flurry of buying and window dress the end of the year. That could provide a tail wind..that's my sense. (Patti Domm, Market Insider)

Friday, November 13, 2009

Southern Steel

Dividend yield = 10/190 = 5.2%

PER = 190/32 = 6

Either Ann Joo is overpriced or Southern Steel underpriced.

I'm buying for med to long term since I've sold all my Ann Joo

Looking for Kinsteel at below 90 sen and Lion Div below 46 sen

Monday, November 9, 2009

The Sentiment is Sell

Financials (led by HLBank) and plantations (led by Sime) trending up. But CPO output/harvest expected to be reduced/poor.

US dollar as funding currency to boost volatility, high yielding assets

http://biz.thestar.com.my/news/story.asp?file=/2009/11/9/business/5033895&sec=business

Wednesday, November 4, 2009

Fed sees rates near zero for "extended period"

As expected, the central bank closed out a two-day meeting with a decision to keep benchmark overnight interest rates in a range of zero to 0.25 percent. The vote was unanimous.

In a statement announcing the decision, the Fed said the U.S. economy had "continued to pick up" since its last meeting in September, but it expressed concern that the economy's recovery was likely to be muted.

"Household spending appears to be expanding but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit," it said. While still emphasizing risks, the Fed was a bit more upbeat than it was in September, when it had simply said spending was "stabilizing.

MORE UPBEAT, BUT STILL WORRIED

The Fed was more explicit than it had been about why it expects to be able to keep overnight rates "exceptionally low" for a long time, citing "low rates of resource utilization, subdued inflation trends, and stable inflation expectations."The central bank, wary of undercutting the fragile recovery by withdrawing its monetary support too soon, has also been on guard for any indication that its emergency lending efforts could fuel an unwelcome bout of inflation down the road.

But top Fed officials, including Chairman Ben Bernanke, have said the U.S. recession, the most painful since the 1930s, has left a legacy of high unemployment and idle factories that should keep price pressures in check.

The government on Friday is expected to report that the drop in employment is abating, the jobless rate is forecast to rise to a fresh 26-year high of 9.9 percent.The world's largest economy grew at a faster-than-expected 3.5 percent annual rate in the third quarter, which effectively signaled the end of the downturn. - Reuters

IJM-WC

Maturity date 24 Oct 2014, therefore exercise/ conversion period = 5 years

Exercise/strike/conversion price = RM 4.00

Exercise/ conversion ratio = 1:1

Unisem. TSM Global

52 weeks: low RM0.45 high RM1.80

TSM Global at RM1.90, wire/cable harness w/ market cap of RM100 million (na RM2.31 eps 38 pe 5). Pays dv 5 sen t/e on 6th Aug 09

52 weeks: low RM0.97 high RM1.96

Banking on Higher Mortgage Rates

Today, with most leading banks poised to raise their mortgage rates, institutional investors may further reduce their holdings on property, construction and automobiles and switch their favour towards banking stocks.

Tuesday, November 3, 2009

Dividend yield stock

Hap Seng at RM2.45 ( na RM4.09 eps 55 pe 5 ) typical dv tax exempted 5 sen Aug, 7 sen Feb. Therefore dividend yield = 12/245 =4.9 %

Even if eps is reduced to 2o, pe still stands at 12 which is not too high.

HS Plantatiion at RM2.15 (na RM2.06 eps 16 pe 14 ) typical dv tax exempted 5 sen June, 4 sen Oct. Therefore dividend yield = 9/215 = 4.2 %

Apex Healthcare at RM1.84 (na RM1.90 eps 19 pe 9) typical dv 4 sen May, 5 sen Sept. Therefore dividend yield = 9/184 = 4.9 %

Rubberex at RM1.93 (na RM1.78 eps 11 pe 19) dv tax exempted 6 sen. therefore dividend yield = 6/193 = 3.1 %

Axis REIT at RM1.94 (na RM1.75 eps 16 pe 12) typical dv 4 sen May, 4 sen July, 4 sen Sept, 4 sen Feb. Therefore dividend yield = 16/195 = 8 %

Saturday, October 31, 2009

Penny stocks

Efficient at 025. Data Processing (na 01, eps 2.4 pe 10 ), dv 0.2 sen ex.3rd Jun

Notion Vtec at 052. HDD components, SLR camera barrel (na 020 eps 4.5 pe 12 peg >2) dv 1 sen Oct/ Mar

Dufu at 044. HDD components (na 064 eps 5 pe 9) dv 1 sen Jan

EPMB at 050. Automative parts (na 129 eps 5 pe 10) eps likely reduced to 3 sen

Hubline at 024. Logistic shipping (na 040 eps 2 pe 12).. (rights issue 1 at 20 sens c/w free warrant for every exist 2 shares at 30 sens on 9th Oct)

Friday, October 30, 2009

TA Global launches prospectus

The executive chairman of TA Global, Datuk Tiah Thee Kian said with the listing, the TA Group would be divided into two main business entities, namely the financial division under TA Enterprise Bhd and the property division under TA Global."The property division will include hotel operations, property management, property investment and property development."

He said TA Global which have three new Klang Valley projects with a gross development value of RM6 billion over a period of seven to 10 years and is now looking towards expansion in Australia and Canada. - Bernama

Wednesday, October 28, 2009

DiGi to pay 80% of earnings as dividends compared to 50% currently

If special dividends and capital repayments are included, both telecommunication companies have typically surpassed paying out more than 100% of net earnings, making them both high dividend yielding stocks.

DiGi also announced a 75 sen special dividend per share, bringing its total payout for the year to RM1.24 per share, giving it a yield of 5.9% at current prices. (This excludes any final dividend payment, which would raise its dividend yield further.)

Recently, StarBiz reported that Maxis will likely pay out more than 85% of net earnings (above its stated policy of 75%) once it is listed, as it will have sufficient cash flows to do so.

DiGi also said it will raise more debt to “better work its balance sheet.” Such funds will be used for capital expenditure and repayments to shareholders.

“We are committed to improving capital management all the time and to reach an optimal balance sheet position. DiGi is still charting growth with a strong operational cash flow and balance sheet. Returning excess cash is part of our effort to provide sustainable long-term yields to our shareholders,” DiGi chief executive Johan Dennelind told StarBiz.

DiGi’s operational cash flow amounted to RM321mil for its third quarter ended Sept 30.

DiGi has a net debt position of RM200mil, which is small compared with its huge annual cash flows. Its net debt to earnings before interest, income tax, depreciation and amortisation (ebitda) ratio is only 0.12 times.

Maxis on the other hand, plans to raise RM5bil in debt, which will give it a net debt to editda ratio of around 2 times. Even that is not high, as it is considered to be at an optimal level for a company like Maxis.

Dennelind added that DiGi’s investment strategy had not changed. “We want investors looking for strong yields from a company that has a track record of execution in the mobile market. We also see growth in this market in all segments,” he said.

Tuesday, October 27, 2009

Market Outlook: Buyers Fatigue

It's a condition labelled as "buyers' fatigue" as buyers see limited upside on the share prices and huge potential fall in prices.

Considering the reward/ risk ratio of 1:1, I would not be interested to purchase anything at the moment and would look to sell on price action rally .

Thursday, October 22, 2009

BJ Sports Toto AGM: Dividends???

Historically, it's around this time of the year that they will declare dividends for their shareholders. Since they were profitable for their first quarter (RM100 million, eps abt 8 sen), let's see if they will... Watch for news...

Kinsteel catching up

Traded 2 counters: Kinsteel (steel sector) and Supermax (gloves/health sector)..

Masteel had some positive news on Tuesday and its share rose above RM1.00 from around 93 sen. In my previous posting, I had pointed the highs and lows of several steel companies counters with their ratio on the current share prices. I remembered Kinsteel at previous year high of RM1.80 and Masteel at RM1.30.

So I figure that Kinsteel at around 95 sen will play catch up. And it did....! Kinsteel have more upside in its share price considering that its fair value at 82 sen and will probably get a re-rating from analyst. Watch Kinsteel prices compared to Masteel.

Similarly Southern Steel (laggard) is playing catch-up with Ann Joo Resources. If memory serves me right, previous year high of Ann Joo was RM4.20 with Southern Steel at RM3.80. You might want to consider grabbing Southern Steel shares (still cheap) before it does catch up Ann Joo's.

There's another similarity in share prices currently between Lion Ind and Perwaja although Lion Ind previous year high above RM4. Knowing all these may help you spot some winners.

Wednesday, October 21, 2009

OSK maintains Buy on Genting Malaysia

"Stripping out its net cash/share of 90 sen, the stock trades at 8.9x FY10 PER.

Maintain BUY with a target price of RM3.25 (10% discount to RNAV of RM3.60)."

Genting M'sia subscribes for Wynn Resorts' US$15m notes

Genting Malaysia said on Wednesday, Oct 21 that it represented a good opportunity for it to expand its investment portfolio and enhance returns on its existing cash balances. "With yield returns in excess of 8%, the investment generates an attractive return compared to what is currently attainable in the money markets or in other secured investments regionally, especially within the Genting Malaysia group's core leisure and hospitality industry," it added.

Tuesday, October 20, 2009

Recent Purchases/ Top-Up

New purchases: TA, Efficen, Hap Seng... TA ((na 145, eps 6, pe 26, dv 4.5... (dv in spicie: 3 TA Global of 50 sen w/ 3 ICPS of 50 sen for every 5 existing, ex 28th Oct.) Efficen (na 12, eps 2.4, pe 10 ))... HapSeng (na 413, eps 20, pe 12, dv 12, dy 5, fair value 240)

Recent top-up: Axiata, GenM, Hubline, IJM

Existing holdings: Axiata, BjToto, Esso, GenM, Hubline, IJM, TDM, THPlant, HSPlant, TM, Digi, QL, Maybank, Lion Div.

Sunday, October 18, 2009

Esso. PetDag. Shell on Better Pricing

Check out Shell and PetDag earnings too.

Accumulate on price share weakness.

If you have bought Esso at RM2.20, its (27 + 5 dividend) % gain at RM2.80 now.

Saturday, October 17, 2009

IGB at 20 months high. Suncity, Glomac, MahSing. BRDB, KSL, IJM

Stocks to watch and buy:

Goldis, SunCity (na 359, eps 28, pe 12, dv 12, fair value 325), Glomac, (na 185, eps 11, pe 12, dv 4.5, fair value 120), MahSing (see previous), BRDB (na 315, eps 22, pe 8, dv 3, fair value 150), KSL (na 185, eps 25, pe 9, dv 5 ex.19/8, fair value 125).

IJM Land, IJM remains my favourites

Wednesday, September 30, 2009

Wilmar delaying HK IPO amid volatile market

“The listing of Wilmar China Limited on The Stock Exchange of Hong Kong Limited is still in progress and has reached an advanced stage but no decision has been taken as to the specific timing of the listing,” Wilmar said in a statement. “The structure and the expected timetable have not been finalised and are dependent on market conditions.”

Wilmar’s share price fell as much as 6 per cent to its lowest in almost six weeks before recovering to trade 3.2 per cent lower at S$6.30 (RM15.47) — still underperforming Singapore’s benchmark index, which was down 0.7 per cent.

Wilmar, which owns oil palm plantations and runs milling, crushing, refining and processing plants in Indonesia and Malaysia, has said the China operation generated about US$600 million in profit and US$14.3 billion in revenues in 2008.

Tuesday, September 29, 2009

PEG Ratio

There's one measure of valuaton, PEG ratio which attempts to compare companies or sectors with differing growth rates. The PEG takes the price/ earnings ratio and divides it by the expected earnings per share growth. The lower the number, the more attractively valued the company or sector.

Take IJM and Gamuda.

IJM at RM6.45 (before ex.) PE = 645/32 = 21. Expected earning per share = 24. So PEG is less than 1.0

Gamuda at RM3.23. PE = 323/ 16 = 20. Expected earning per share = 8. So PEG is about 2.5

Both companies have similar PE ratio but expected eps for IJM is higher. Which then is an attractive valued stock..?

You can do this simple exercise for several of the companies you're contemplating buying into and post your comments here.

Monday, September 28, 2009

TA cuts major Malaysia stocks to sell

The downgraded stocks include CIMB, Gamuda, IOI Corp, Sime Darby, Tenaga and TM . The research firm also has a “maintain sell or take profit" call on Kencana Petroleum, SapuraCrest and Kurnia Asia for further correction from recent gains.

TA has recommended "buy on dip" in its daily note for lower liner construction-related stocks such as Sino Huaan, Kinsteel , MRCB, UEM Land, Zelan, and LCL Corp.

Friday, September 25, 2009

Oil Set To Slide. A Rising Market Feeds Itself

This notion that broader economic conditions are recovering is an interesting one. Things might be getting ‘less bad’ but in truth, the only ‘indicator’ that’s really taking off is the stock market. Bulls often like to point out that the stock market doesn’t necessarily need the economy to be strong for it to put in a good performance, which is a fair point. But at the same time, investors tend to assume that a rising market means that the economy must be getting better.

As MoneyWeek regular, Pali International’s James Ferguson, points out in this week’s story: Just how long can this rally go on?, a rising market feeds off itself. People see the market going up, and they start to believe that it contains genuine information. After all, if the market’s efficient and the market’s always right, then if it’s rising, an economic recovery must be just around the corner. And if a recovery is just around the corner, you want to be buying stocks. So investors buy stocks, driving the market up even further.

Of course, then they see the market rocketing, and assume that this means the recovery is going to be even stronger than anyone expects. Which means you should be buying even more stocks. After all, who are you to question the market? But eventually the market reaches a point where it’s supremely vulnerable to disappointment, and investors start to expect some sort of genuine economic recovery. And when they’re disappointed, we’re likely to see all sort of assets take a tumble, stocks, oil, and even gold – at least in the short-term.

Sunday, September 20, 2009

Citigroup keeps 'sell' calls on IOI, KLK, IJM Plantations

It also downgraded Sime Darby Bhd to "hold" from "buy", having considered the conglomerate's valuations no longer compelling."An attractive feature of Sime Darby was its dividend yield. But with the recent share price rally, dividend yield is close to only 3 per cent currently," Citigroup said in a research note to investors.

Malaysian plantation stocks are highly valued, thanks to buying from local funds. Foreign shareholdings for Sime Darby and KLK are still below below 15 per cent of total shareholding.

With the rise in palm oil prices over the past two months, price to earnings (PE) of Malaysian plantation counters are now above or at historical averages. The research house expects palm oil prices to stay flat in the near term

Thursday, September 17, 2009

Stocks struggle to hold one-year highs

Stocks struggled to move higher Thursday morning, as enthusiasm over upbeat housing and jobs reports waned and the major gauges continued to flirt with one-year highs.

The Dow Jones industrial average (INDU) edged up 17 points, or 0.2%, after ending the previous session at its highest point since Oct. 6, 2008. The S&P 500 (SPX) index gained about 2 points, after ending the previous session at its highest point since Oct. 3 of last year. The Nasdaq composite (COMP) was flat after closing at its highest point since Sept. 26, 2008.

U.S. stocks spiked to one-year highs Wednesday amid continued economic optimism. Thursday brought new reports supporting hopes that a recovery is underway, but investors weren't impressed.

A combination of improving economic news and fiscal and monetary stimulus has helped boost stocks over the last six months. Since bottoming at a 12-year low in March, the Dow has gained 47% and the S&P 500 has gained 55%. Since bottoming at a 6-year low, the Nasdaq has gained 65%.

But this is cause for concern rather than celebration, said Philip Isherwood, equities strategist at Evolution Securities in London. He said the markets are being artificially inflated by the massive stimulus from the U.S. and other governments, "rather than realistically reflecting fundamentals."

"At some point you'd expect markets to reconnect with a more muted reality, but short term that isn't the case," said Isherwood. "The market doesn't wait for the economy and it doesn't wait for investors, either."

There could be some volatility ahead of Friday, the day of quadruple witching, when contracts expire on stock index futures, stock index options, stock options and single stock futures.

Tuesday, September 15, 2009

Citi shares could, finally, see solid demand

Citigroup may also have suffered many of the steepest losses it faced in its consumer loan and lease portfolio. The government is covering some potential losses on the bank's most toxic assets, and Citigroup shares trade at a lower valuation than many of its competitors.

That seems to be translating to investor demand. Citigroup shares have more than quadrupled since early March, closing Tuesday at $4.12.

Even hedge fund manager John Paulson, who famously shorted banks and brokers going into the financial crisis, has been buying the bank's shares, a source familiar with the matter said.

Three other fund managers who long shunned the stock said they may start buying. They requested anonymity because they do not want to disclose investment positions they have not taken.

"If you've got a one-to-two year time horizon, the stock could trade into the teens," said Marshall Front, chairman of Front Barnett Associates in Chicago, who also bought Citigroup stock recently. "The possible reward looks good compared to the risk."

In the near term, there are risks.

The bank has been profitable in each of the last two quarters because of one-time gains and accounting items, but has not posted a quarterly profit from its main operations since 2007.

There is also the risk of the government selling a large number of shares into the market. Concerns about such a sale drove Citi shares down 8.85 percent on Tuesday.

LOW INSTITUTIONAL OWNERSHIP

Sources told Reuters the bank is talking to the government about how the U.S. should shed its 7.7 billion Citi shares.

The bank may sell another $5 billion of shares to raise funds to start buying back about $27 billion of other Citi securities that the government owns, the sources said. Those securities, known as trust preferreds, are a hybrid of stocks and bonds. These sources requested anonymity because the talks are private.

Thursday, September 10, 2009

Time for Rebalancing My Portfolio

Now that I'm back, I'm getting the feel of the sentiment of the local stock market for the past 2 weeks by reading my favourite list of blogger's site. Bloggers are such a wonderful lot to thank for. I've always appreciate the time, effort and energy they've put into sharing their thoughts with the blogging community.

Cautiously optimistic, I'll buy into the market. My current shares/ cash ratio is 60/40 and I'll increase my shares holding upto 90%.

Current holdings = Axiata, BJtoto, DIGI, GenM, HSPlant, Hubline, LionDiv, MBB, QL Reso, TDM, THPlant, TM

Sold = AnnJoo, Axiata (part), IJMLand, QL (part)

Opinion = still overweight on property, resorts, building materials, telecommunication, power generation. Loves Axiata, Digi, GPacket, AnnJoo, SouthSteel, LionInd, Kinsteel, LeaderU, YTLCement, IGB, IJMLand, E & O, Maybulk, YTLPower

Friday, August 28, 2009

Capitaland. China Mobile

Thursday, August 27, 2009

Axiata Q2 profit jumps 44pc

The net profit of RM526.84 million is also its best quarterly performance since its listing a year ago.Axiata, which has more than 100 million customers spread over seven countries, also thinks it can almost meet its main financial targets for this year.It aims to grow revenue by 6-11 per cent and operating profit or Ebitda by 4-6 per cent, among others.Ebitda, or earnings before interest, tax, depreciation and amortisation, rose 2 per cent to RM1.24 billion from a year ago. Its revenue rose by 7.8 per cent to RM3.16 billion during the period, against RM2.93 billion last year

DiGi sees 3G as growth driver in 2 years

Malaysia’s third-ranked mobile operator plans to spend up to RM400 million (US$113 million) a year to build up its 3G capacity over the next few years as it plays catch-up with bigger rivals who have been in the 3G market for more than two years.“Our key positionings are around 3G and Internet services,” DiGi CEO Johan Dennelind told Reuters in an interview.

Dennelind said 3G broadband will be “a significant part of the revenue growth” to DiGi in 2011, and he expects traditional voice and data services to drive growth for the time being.

The big capital outlays required for 3G broadband services would not affect DiGi’s dividend policy, Dennelind said.“We are a dividend story. Our dividend policy is to pay out at least 50 percent of net earnings. I don’t see any reason why we should change that,” he said. - Reuters

Tuesday, August 25, 2009

Is it Time to Get In or Get Out..?

Market is rising but trading volume is low and has been declining.

Low volume suggests there are simply not a lot of buyers and sellers. Potential buyers are waiting for lower prices to get in. Sellers are waiting for higher prices to sell. So aggressive selling and buying are tapering off.

Taking a loss is difficult for most investors. Some investors are waiting for higher prices to "get even and get out". Look for these investors to start selling again, the closer they get to “even”. Some will lose hope and dump after they’ve suffered big losses.

Either way, we will see more selling than buying down the road.

(adapted from Bob Irish's Investor’s Daily Edge)

Monday, August 17, 2009

Perceived Support Levels: Properties Stock Counters

KLCI slid to 1169 after losing about 20 points, triggering my buying interest on some properties & construction stocks. So I did a quick check on some of the counters with the most likely strong support/ buy levels.

E & O ( RM 1.06 - 1.10 ). IJM Land ( RM 1.60 - 1.70 ). IGB, Mah Sing, YNH ( RM 1.75 - 1.80 ). Sunrise ( RM 1.85 - 1.95 ). D & P ( RM 1.10 - 1.16 ). MRCB ( RM 1.10 - 1.20 ).

Other counters that might interest me at their support levels: TA ( RM 1.00 - 1.10 ). MPHB ( RM 1.66 - 1.70 ). Gen M ( RM 2.65 - 2.75 ) . Axiata ( RM 2.93 - 2.96 ). G Packet, Leader U ( RM 0.70 - 0.73 ). RCE ( RM 0.60 - 0.65 ). Lion Div ( RM 0.50 - 0.53 ). Lion Ind ( RM 1. 25 - 1.36 )

This is not a recomendation to buy the above stocks the instance the stock prices hit their respective support levels. Rather take time to monitor the price action to ensure that these levels are the support levels where buying is strong.

And remember: Don't buy to hold long, sell whenever the market gives you gain/profit. It's impossible to rob the market.

Is Malaysia ready for retail bond market?

Criticisms range from the affordability of bonds to the complexities involved in bond trading, which can arguably be beyond the grasp of the average retail investor. Bonds, with their fixed return rates, are typically considered safer investing instruments than equities, although the relative ratings of the instruments must be taken into consideration.

Speaking to The Edge Financial Daily recently, Lee said the next major step forward for the local debt market would be to implement retail-side service. “The next big step is the retail bond market. Typically, you don’t want to let retailers invest in credit ratings that are too far down the credit curve to protect them because they are not in the same position as a big unit trust or big fund manager to study the credit terms. You would want to have some minimum standards and credit rating they can buy into. Having said that, once you allow them access into the bond market, the yield is much higher than bank deposits.”

Moreover, there is an argument to be made that the papers of some corporates, or private debt securities (PDS), which are highly rated — AA or higher — are safer investment instruments than some of the equities available on Bursa Malaysia presently.

Lee said the bond market did not need to incur additional costs, but could use the same existing platform of the equities market. “When you develop a retail bond market, you don’t want to create unnecessary costs. Just piggy-back on the stock exchange infrastructure and use the same platform. Instead of quoting equities, you list the bonds there. Instead of dividends, you have a coupon.

Thursday, August 13, 2009

IJM Land. E & O. Mah Sing. IGB

Sales of the proposed 2 blocks of luxury condominium "Light Linear" launched in Penang last few weeks were overwhelming. IJM Land expects the launching of another single tower luxury condominium "Light Point" by year end to be well received.

Buy IJM Land for short to med term. I wish it was still at RM 1.61

Ditto for E & O, Mah Sing and IGB

Tuesday, August 11, 2009

Warren Buffett Makes Big Bet on Fixed Income

Buffet's investment company Berkshire Hathaway held $11.1 billion in foreign government bonds in its insurance units as of June 30, compared with $9.6 billion three months earlier, the company said in a regulatory filing.

Berkshire's investments in companies such as plane-rental business NetJets and financial institution Wells Fargo have turned out to be poor bets while securities issued by Goldman Sachs and General Electric are offsetting slumping equity investments.

“Some of the normal places he’s gotten the cash to invest are just getting killed in the recession,” Gerald Martin, a finance professor at American University’s Kogod School of Business in Washington, told Bloomberg. “So he’s locking in these guaranteed returns, moving from the volatility of stocks to a steady stream of income that, in some cases, is almost at the return you normally get from the stock market.”

Friday, August 7, 2009

Markets Recede

4.15 pm..

Euro markets: UK FTSE, France CAC, Germany DAX all down by 1 %.

Asian markets: HKSE down 2.5 % and STI down by 2 %.

KNM and SAAG on the downtrend. KNM likely support at 82 sen and SAAG at 26 sen.

Sold Axiata. Buy in on dips..

Thursday, August 6, 2009

Southern Steel

Group revenue fell to RM488.4mil from RM977.5mil a year ago.

“The drop in revenue was in line with the contraction in steel demand and lower prices experienced since the second half of 2008,” the company said in notes accompanying its financial results yesterday.

For the six months to June 30, it recorded a net loss of RM78.1mil against a net profit of RM298.8mil in the previous corresponding period.

On prospects, the company said the worst in this economic downturn appeared to be over .

“The board is cautiously optimistic that the performance of the group will continue to improve for the rest of the financial year,” it said.

For the financial year ending Dec 31, an interim tax exempt dividend of 2.5% (2008: first interim 7.5%) has been approved and will be payable on Sept 11.

Southern Steel

Group revenue fell to RM488.4mil from RM977.5mil a year ago.

“The drop in revenue was in line with the contraction in steel demand and lower prices experienced since the second half of 2008,” the company said in notes accompanying its financial results yesterday.

For the six months to June 30, it recorded a net loss of RM78.1mil against a net profit of RM298.8mil in the previous corresponding period.

On prospects, the company said the worst in this economic downturn appeared to be over .

“The board is cautiously optimistic that the performance of the group will continue to improve for the rest of the financial year,” it said.

For the financial year ending Dec 31, an interim tax exempt dividend of 2.5% (2008: first interim 7.5%) has been approved and will be payable on Sept 11.

Wednesday, July 29, 2009

Maybank May Cut Dividends to 30 sen

Year 2009 total EPS = 48 sen (my estimate). No dividend has been paid out so far. Coming August, what will Maybank pay its shareholders is anyone's guess.

My guess is 30 sen. Therefore dividend yield = 30/650 = 4.7 %

If you're hoping for 5 % dividend yield, then look to buy at 30 sen/ 0.05 = RM 6.00

If you had bought earlier at RM 5.00, then you might just earn 6 % dividend this August.

Citigroup to give US govt 34% stake

Investors have agreed to swap US$32.8 billion of preferred securities for common stock, and the government will swap US$25 billion. Citigroup conducted the offers after heavy credit losses and writedowns prompted a series of bailouts, including a US$45 billion injection of taxpayer funds from the Troubled Asset Relief Program. The bank increased the total size of the offers by US$5.5 billion after regulators ordered it to build that buffer following a "stress test" of its ability to handle a deep recession.

The exchange offers will leave Citigroup with more than 21 billion shares, up from 5.51 billion at the end of June. Citigroup has said it may conduct a reverse stock split before June 30, 2010, that would increase its share price, which has hovered near US$3 for much of the year.

Boustead. Digi.

Its group managing director Tan Sri Lodin Wok Kamaruddin said the fund raising exercises “will enable the group to trim down its debt level, and at the same time get fresh funds for new acquisitions”.

“We want to rationalise our operations and focus on key areas;’’ property development, grow its plantation acreage and group’s shipyard operations.

DiGi Telecommunications Sdn Bhd has been named Malaysia’s most admired company for innovation by Wall Street Journal Asia for the third year running .

In a statement, the company said the Asia 200 Most Admired Companies survey also graded DiGi number three in the overall ranking of Malaysia’s Top 10 companies, up a notch from last year.

CEO Johan Dennelind ...For us, innovation is about bringing meaningful differences to our customers by making our mobile and internet services relevant, easy and affordable.” He added the company was passionate about exceeding its customers’ expectations and would continue to push the boundaries in ensuring excellent customer experience.

Tuesday, July 28, 2009

Sime's Dividend May Be Trimmed

Up to third quarters ending May 2009, eps todate =21 sen only. With the fourth quarter earnings announcement due in Aug, I think Sime will not be able to match their 2008 total earnings and dividend payout.

More likely total earnings = 45 sen and dividend paid for year 2009 = 30 sen.

If this be the case, my fair price of Sime = 30 sen/0.04 = RM 7.50

P/E = 17

Monday, July 27, 2009

Major Currencies, Crude and Gold Inch Higher

European currencies up against Swiss franc. British pound climbs against US dollar.

CRB index inches up to 252 level. Crude and spot gold at US68/barrel and US955/oz.. Dollar index down at 78...

Malaysian stocks GenM (Resorts) taking higher grounds at RM 3.00, with Axiata (Telco) in hot pursuit of matching at least RM2.99 (net asset)...

Market info has it that the price of long steel bars in Malaysia has been reduced by RM100, from RM 1900 plus to RM 1800 plus... Noted...

Sunday, July 26, 2009

Axiata, Digi, PPB, QL: Capital Expenditure

Saturday, July 25, 2009

DIGI = Dividend Stock

DIGI recently announced dividend payout of 49 sen, going ex. 1st Sept, payout 18th Sept 2009. Assuming 2009 total yearly payout of RM 1.50, yield = 150/ 2200 = 0.68 or 6.8 %

Looking at the financial summary of recent quarters, the revenues profits and earnings per share look sustainable. Total 2008 dividend payout = RM 1.88 therefore yielding 188/2200 = 8.5 %

Buy Digi for med to long term for dividend.

Do consider TM for 6 - 8 % dividend play also.

Buy Axiata on stock price dips for active trades or long term regional growth or buyout.

IOI Corp Stock Still Pricey To Me

My personal opinion.........: No, not yet.... But for active trading gains--> yes..

IOI historic dividend payout for year 2008 = 17 sen

My criteria of fair price to pay for stock would be they generate at least a 5 % return dividend yield, so my fair price = 17 sen/ 0.05 = 340 sen or RM 3.40

This would be the price I'm willing to pay for the purchase, or RM 3.70 max

Earnings of IOI = 36 sen, so P/E = 340/36 = 9.4 (I'm comfortable with PE < 12)

But if you think earnings and dividends of IOI may increase in the near future, you may consider your purchase when stock price is at 17 sen/0.04 = 425 sen or RM 4.24 (PE abt 12)

Once earnings and dividends payout increases, stock price will appreciate..

IOI stock price recently closed at RM 4.86 (PE = 14)

Assuming you buy at this price to hold short/med term, your dividend yield may be 17 sen/486 = 0.035 or 3.5 % provided earnings remain 36 sen.

But looking at 2009 dividend payout ending June = 6 sen, and with the rights issue to raise cash, they may face difficulty matching 2008 dividend amount. This may mean that IOI is facing problem with earnings and thus stock price will drop. Assuming earnings drop to 18 sen, dvd payout is 9 sen, therefore P/E = 4.86/0.18 = 27 (high) and dvd yield = 9/486 = 1.9 %

Not a stock buy and hold for dividend. A stock for current short term trade, yes.

There're better stocks to buy for dividend play.

Thursday, July 23, 2009

Three Lions Roar Again.

Kinsteel and Perwaja surge approx. 6 %

Ann Joo led the trend a couple of days ago with unrelenting gain, starting at RM 2.06 on Monday and closing today aroung RM 2.24

Laggard Southern Steel started from RM 1.60 on Monday and ended today at RM 1.74

Recommendation:

Buy Lion Div. Lion Ind. Southern Steel. Masteel

I'm still holding Ann Joo, buying into Lion Div, S Steel

Sunday, July 19, 2009

Plantations = Sustainable Business

I've been asked numerous times why I continue to advocate buying into plantation stocks. The simplest digestable reason is because the business is generally sustainable. It doesn't take rocket science to figure this one out.

Sime, IOI, KLK, GenP are investor's favourites and mine that see seemingly active trades. But for my core holding of plantation stocks that I buy and hold for dividend yield, here it is: TH plant, HS plant, TDM.

Fair Price Evaluation:

An extremely simple method to evaluate a reasonable fair price for some dividend yielding stocks is to take the historic dividend paid out/dividend yield. Assume earnings are sustainable, here's some valuation..

TH Plant. 14 sen/0.09 = 155 sen or RM 1.55

HS Plant. 10 sen/0.05 = 200 sen

TDM. 14 sen/0.08 = 175 sen

Let's look at others:

IJM Plant. 12 sen/0.05 = 240 sen

Boustead. 30 sen/0.09 = 300 sen

Sime 45 sen/0.06 = 750 sen

IOI 17 sen/0.04 = 425 sen

For some non-plantations:

Esso. 12 sen/0.05 = 220 sen

Pet Dag 45 sen/ 0.05 = 900 sen or RM 9.00

PLUS 16 sen/0.05 = 320 sen

GenM. 8 sen/0.03 = 265 sen

BjToto 26 sen/0.05 = 520 sen

Leader 3 sen/0.04 = 75 sen

Prestar 1.5 sen/0.03 = 50 sen

TM 26 sen/0.09 = 289 sen

Tanjong 73 sen/0.06 = 1216 sen or RM 12.16

YTL P 11 sen/ 0.05 = 220 sen

PPB 23 sen/0.02 = 1150 sen

Astro 10 sen/0.03 = 333 sen

MPHB 10 sen/0.06 = 166 sen

IJM 25 sen/ 0.05 = 500 sen

Bursa 18 sen/ 0.03 = 600 sen

KFima 3 sen/ o.04 = 75 sen

Pantech 3 sen/o.o4 = 75 sen

Ann Joo 12 sen/0.06 = 200 sen

S Steel 12.5/0.07 = 178 sen

There you go....

You can choose any stocks, look up its earnings, its historic dividend payout, its purported dividend yield and evaluate a fair price to purchase the stocks...

Friday, July 17, 2009

Putting the Gold in Goldman

Paulson explained how he “saved” Merrill Lynch. Left unsaid was how he destroyed the American system of free enterprise in the process. Paulson's testimony was alarming on at least three counts. First, he blatantly admitted to a form of coercion that closely resembles illegal intrusion into a private enterprise. Second, he offered his testimony as if it portrayed an honorable reaction to the credit crisis, rather than a dishonorable dereliction of his duties as Treasury Secretary. Third, no one seemed to care what crimes Hank Paulson may or may not have committed…as long as the stock market continued to rally.

In his own words, the law-bending former Treasury Secretary explained:“[S]ome have suggested that there was something inappropriate about my conversation of December 21st with [Bank of America CEO, Ken] Lewis in which I mentioned the possibility that the Federal Reserve could remove management and the board of Bank of America if the bank invoked the MAC clause [i.e., the material adverse condition clause to pull out of the Merrill takeover]. I believe my remarks to Mr. Lewis were appropriate. I explained to him that the government was supportive of Bank of America, but that it felt very strongly that if Bank of America exercised the MAC clause, such an action would show a colossal lack of judgment and would jeopardize Bank of America, Merrill Lynch, and the financial system. I further explained to him that, under such circumstances, the Federal Reserve could exercise its authority to remove management and the board of Bank of America. By referring to the Federal Reserve’s supervisory powers, I intended to deliver a str ong message reinforcing the view that had been consistently expressed by the Federal Reserve, as Bank of America’s regulator, and shared by the Treasury, that it would be unthinkable for Bank of America to take this destructive action for which there was no reasonable legal basis and which would show a lack of judgment.”

So there you have it. Lewis could have chosen either to abide by Hank Paulson's wishes or he could have chosen to "show a colossal lack of judgment” by pursuing a "destructive action for which there was no reasonable legal basis.” In other words, Paulson gave Lewis an offer he couldn't refuse: “Do what I say or be dismissed from Bank of America in disgrace.” Reading between the lines, it is not hard to imagine that Paulson’s threat also contained the implied threat of federal indictments and subpoenas, if Lewis failed to "play ball." Gee, sounds perfectly legal to us.

Meanwhile, back at the former Treasury Secretary's old stomping grounds, business continues as usual…or rather, as UN-usual. Despite the enormous volatility besetting all major financial markets during the last two years, Goldman Sachs has steadily increased its risk exposure, as measured by value-at-risk (VAR) – a widely utilized risk metric. VAR, as presented in Goldman’s quarterly reports, displays the firm’s probable maximum loss per trading day. During the recent quarter, Goldman’s daily VAR established a new record high for the firm of $245 million. One might have imagined that last fall's stock market collapse, coupled with the near-implosion of the financial system, would have reduced Goldman's appetite for risk just a smidge. But the VAR data tell the exact opposite story.Goldman upped its risk exposure, even while borrowing billions of dollars from the government. And by the way, Goldman's VAR did not merely increase in absolute terms, it also increased relative to the size of the company’s shareholder equity. In other words, no matter how you slice or dice the numbers, this swashbuckling financial firm has been ramping up its risk exposure.

This disturbing fact leads your California editor to ponder a couple of troubling thoughts:

Thought #1: Goldman's VAR data make all of us American taxpayers into complete stooges – utter patsies. Here we were, wringing our hands, listening to Wall Street's CEO’s tell us how urgently we needed to rescue the financial system, and watching Washington's elected (and unelected) officials dole out hundreds of billions of dollars to Wall Street firms.

But there THEY were, taking the bailout monies and taking the subsidized loans, in order to take advantage of the collective national desire to save our financial system. There THEY were INCREASING the balance sheet risks that landed us in this desperate situation in the first place!

Thought #2 (possibly related to Thought #1) Goldman’s new risks may not be as risky as they would appear. Here's why: Bear Stearns and Lehman Brothers are gone, while Bank of America/Merrill Lynch, Citigroup, AIG and many other financial firms remained hobbled by their crippled balance sheets. Thus, several of Goldman’s former competitors are in no condition to compete. Without competition, therefore, Goldman's stated risk exposure may not be as risky as it would appear.Is there a connection between Goldman's soaring VAR and its disappearing competitors? Maybe.

Looking back over the last 12 months, we are all left to wonder why the former Treasury Secretary enabled some financial firms to survive, forced others into the arms of unwilling saviors and allowed others to fall into bankruptcy. No immediately apparent logic seemed to guide these disparate responses. To be a struggling financial firm in 2008 was to be a wife of Henry VIII - divorced, beheaded, died, divorced, beheaded, survived.And since no immediately apparent logic seemed to guide these capricious responses, perhaps some clandestine - or nefarious - logic guided these responses.

AIG survived, for example, and it promptly paid millions of dollars to Goldman Sachs to settle counterparty transactions. Lehman Brothers, on the other hand, died. Lehman’s elimination from the marketplace as a competitor bestowed an immediate and direct benefit to Goldman Sachs. Hmmmm…. interesting. (And let’s not forget that the decision to let Lehman fail and to bailout AIG both emerged from the same closed-door meeting between Hank Paulson and various finance company CEO’s, including Goldman CEO, Lloyd Blankfein. We're not pointing fingers, just raising a very skeptical eyebrow).All of this is ancient history, of course. And a delightful history is. Goldman Sachs is now America's most prosperous financial firm and the stock market is about 2,000 points above the low it hit in early March. So maybe it's time for critical skeptics and skeptical critics - like your California editor - to keep his mouth shut and enjoy the fruits of government intervention.

Maybe. But we critical skeptics can't seem to shake off our nagging suspicion that these fruits are rotten to the core, and that the first delectable morsels of our apparent economic "recovery" merely conceal the diseased morsels in the center. Goldman Sachs is thriving. Main Street is still breaking down. To pretend otherwise is to embrace the sorts of delusions that usually produce large capital losses(Rude Awakening's Editor Eric Fry).

Thursday, July 16, 2009

Market Rally on the Gold in Goldman

Yesterday morning we learned that America's industrial production was “less bad” than expected. Specifically, output at the nation's factories, mines and utilities fell “only” 0.4% in June - the smallest monthly drop in eight months. This terrific economic news, coupled with a cosmetically pleasing earnings report from Intel, powered the Dow Jones Industrial Average to a gain of 256 points.

Curiously, investors did not seem troubled that the very same report showing a modest – albeit seventh straight - drop in industrial production also showed a drop in capacity utilization to 68% - the lowest such reading in more than 40 years. Nor did investors seemed terribly troubled that the consumer price index (CPI) for June jumped a hefty 0.7%.

Nope, they didn’t seem troubled one bit. Instead, investors read the headlines, waited for CNBC to tell them the headlines were good, then rushed to buy stocks. By the time the dust had settled, several high-profile stocks like Intel (INTC), Microsoft (MSFT) and Goldman Sachs (GS) had reached fresh highs for the year. The stock market darlings never looked so adorable!

We’re happy to see points on the board, but distrustful of their durability. As we (almost) never tire of pointing out, “less bad” is not good, even though it might feel like it for a little while. Furthermore, no matter how many billions of dollars Goldman Sachs might make for itself (after the elimination of Lehman by former Treasury Sec. Hank Paulson) by playing games on computer screens, the overall economy will never regain its vigor until industrial production actually INCREASES, and until capacity utilization moves meaningfully higher than it was during the Johnson Administration.

The U.S. economy is still struggling. And the credit markets are still failing to function – mostly because the roots of the American financial system remain diseased. Thanks to the crisis-deferral tactics of former Treasury Secretary Hank Paulson and Federal Reserve Chairman Ben Bernanke, the American banking system is now grafted onto the diseased roots of dishonest asset pricing, deceptive accounting, capricious government intervention and malign regulatory overhauls.

We had the chance to implement constructive changes and we blew it. When we finally had the chance to purge of the rot from the financial system, we chose the exact opposite path: we bailed out the rot, and forced the healthy to subsidize the process. A handful of privileged folks are benefiting. The rest of us are paying with our taxes (Rude Awakening's Eric Fry).

Earnings: Nokia, Marriott, Harley, Baxter. Lender CIT

Marriott International posts 76 percent slide in 2nd-quarter net income on lower revenue and hefty restructuring charges. The hotel operator also gave an outlook for the third quarter and full year that fell far short of Wall Street's expectations. Marriott and others in the industry have suffered in the recession as both business and leisure travel wane.

Harley-Davidson Inc. said Thursday it is cutting 1,000 more employees and lowering its motorcycle shipment guidance as quarterly earnings continued to fall due to weaker sales

Specialty drug and medical device maker Baxter International Inc. said Thursday its profit rose 8 percent in the second quarter on better margins, more than offsetting a decline in sales....

Stock futures are trading in a narrow range Thursday after excitement that JPMorgan Chase & Co.'s earnings easily beat estimates was tempered by concern that a top lender to small businesses could collapse. Overseas markets were modestly higher. The market had been surging throughout the week on upbeat earnings reports and forecasts, restarting a rally that stalled last month. After three days of gains, caution has returned as small and midsize business lender CIT Group Inc. said negotiations with regulators about a possible rescue broke off after days of talks. That raised expectations that the New York-based financial firm could file for bankruptcy protection

Monday, July 13, 2009

Making Money From the Market

By 1995, JWH was one of the largest asset-management firms in the world, with over $1 billion under management. By 2005, he controlled over $3.4 billion... In a recent Bloomberg magazine article, Henry states that he only makes money on 38%-40% of his trades. In other words, more than 60% of his trades lose money. Even though most of his trades are losers, Henry is still able to make a fortune from the market.

According to this article, John Henry's Financial and Metals Portfolio has returned 22% annually over the last 25 years... That's a better track record than Warren Buffett, the world's most famous investor. Buffett has returned 20% a year over the last 44 years.

Last year, while the S&P was plunging 38%, the Financial and Metals Portfolio rose 47%. There are two pillars to John Henry's trading style. First, he follows trends. He doesn't care about economic growth, budget deficits, or unemployment rates. When a stock rises, he buys it. When a stock is falling, he shorts it. It's as simple as that. As John Henry puts it, "We buy high and sell low."

Second, he lets his winners run and he cuts his losses quickly. This is why he has such a high percentage of losers. He takes many small losses. But when he finds a big trend, he rides it as far as he can.

Henry is proof that you can make millions in the market by taking lots of small losses... and holding onto huge winners that far exceed the little dings along the way. He's proof that "cut your losers and ride your winners" works day in and day out.

You can copy John Henry's trading style by looking for "breakouts." This is when a stock or commodity busts through to a new price level. It works in both up and down markets. Using breakouts to dictate your trading – even if you're paying attention to fundamental things like valuations and supply/demand – assures that you trade with the market, rather than against it (Daily Wealth's Tom Dyson).

Friday, July 10, 2009

S&P500 Head/Shoulders Projection

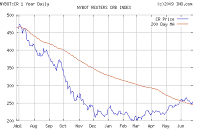

CRUDE OIL JUST VIOLATED ITS TRENDLINE

For you "trend watchers" out there: Crude oil is looking bearish these days...

For you "trend watchers" out there: Crude oil is looking bearish these days...After suffering one of its greatest collapses of all time, crude oil became super-cheap relative to gold late last year. Crude rallied over 100% after that.

But as we noted three weeks ago, oil is no longer a bargain compared to gold. The "easy, early" money has already been made going long oil. Now, the money is being made on the short side.

Oil is down 12% in the past month. And as you can see from today's chart, oil just sliced through its bullish trendline, which has been in force since March. That's the bearish "technical side" of the market...

On the fundamental side, you have a weak economy using less gasoline. Worldwide usage is suffering its worst decline in nearly 30 years. Above-ground supplies of fuel are robust. Given the supply/demand picture and the bearish trendline violation, crude could easily make its way back down to $50 per barrel (Brian Hunt's Market Notes).

Major Crossroads: Buyers Exhausted

Tuesday, July 7, 2009

Stick with Defensive Stocks, for now.

Monday, June 29, 2009

China Stocks Crazy Rally

Friday, June 26, 2009

Commodities Index Staying Above 200day MA

Tuesday, June 23, 2009

Gold Stocks: Jeff Clark's Buy Point

Wednesday, June 10, 2009

O n G. PANTECH, DELEUM

EPS = net profit 59m/ shares issued 375m = 16 sen

Dv = 3 sen, dv yield = 4 %, "fair price" = 3/ 0.04 = 75 sen

PE = current price 85/16 = 6

NA = RM0.53

Deleum

EPS = 30m/ 100m = 30 sen

Dv = 11 sen, dv yield = 7 %, "fair price" = 11/0.07 = RM1.57

PE = 166/30 = 6

NA = RM 1.46

KLCCP, PLUS, BJ TOTO

EPS = net profit RM 836m/ 936m shares issued = 89 sen.

PE = current price 3.20/0.89 = 3.6

Dividend = 10 sen. Dv yield = 3 %. "Fair price" = 10/0.03 = RM 3.33

Net asset = RM4.36

Current price of RM 3.20 is a good buy.

PLUS

EPS = 1080m/5000m = 21 sen

Total dv = 16 sen, dv yield = 5 %. "Fair price" = 16 / 0.05 = RM3.20

NA = RM1.14

Final dv 9.5 sen goes ex. 9th June, pays 2th July

BJ TOTO

NA RM0.26

EPS = 348m/1351m = 28 sen

Total dv = 26 sen, dv yield = 5 %

"Fair price" = 26/0.05 = RM5.20

Sunday, June 7, 2009

Euro/Dollar: Prices Break Channel Support, Signal Short

Thursday, June 4, 2009

Malaysia's Steel Industry

PETALING JAYA: The outlook for the domestic steel sector should be brighter going forward as the slump in the industry has bottomed out following losses of about RM485.9mil in the first quarter and even more in the fourth quarter of last year, analysts said.

PETALING JAYA: The outlook for the domestic steel sector should be brighter going forward as the slump in the industry has bottomed out following losses of about RM485.9mil in the first quarter and even more in the fourth quarter of last year, analysts said.The worst is clearly over for the steel industry and earnings are expected to stage a strong turnaround in the third quarter of this year, according to AmResearch senior analyst Mak Hoy Ken.

Most steel mills continued to be in the red in the quarter ended March 31, 2009.

However, Mak noted that the quantum of losses for players such as Ann Joo Resources Bhd, Perwaja Holdings Bhd and Southern Steel Bhd had been reduced substantially in the absence of further write-downs in the value of their inventories.

Prices of long steel products (used for construction works) rebounded by 25% to RM2,000 per tonne currently from a low of RM1,600 per tonne in April.

It peaked at RM4,000 per tonne in mid-2008.

Credit Suisse said in a note on Wednesday that steel prices would be on the uptrend as a result of the Government’s pump-priming initiatives.

Wednesday, June 3, 2009

RCE Capital, Leaders Universal

Other info: Net profit = RM66m y/y up 32%. Shares issued = 710m. therefore EPS = 66/710 = 9 sen. Current price/ eps = 60/9 = 7. NA = 32 sen

Leaders Universal interim dvd = 1.5 sen. ex 12/6, pay 26/6. Net asset = RM1.14

Net year profit = 86m. Shares issued = 436m. EPS = 14 sen.

Current price = 72 sen. PE = 72/14 = 5.

Assuming two dvd per year, 'fair price' = 2 x 1.5 sen / 0.04 record yield = 75 sen.

Buy at 70 - 72 sen range.

Commodity Index Stalled

Is this the end of the commodity rally..? And end of rally for emerging markets..? Will funds exit emerging markets and flow back to US..? And US dollar regain its strength..?

Major currencies also plunges against the US dollar today.

USD up against Yen and Swiss dollar.

Monday, June 1, 2009

Saturday, May 30, 2009

Thursday, May 28, 2009

Kinsteel, Resorts. E&O. KNM

Kinsteel tumbled from 91 to 87 sen bf closing at 89. It should find support at 82 - 85 sen range.

E&O fall from 81 sen to 76. Let's see if it will break below 70 sen.

KNM still holding well but I suspect it will also slide to 75 sen.

Wednesday, May 27, 2009

Kinsteel "Fair Price"

Dividend declared = 1.7 sen tax exempted.

Dividend yield from its record = 2 %.

So "fair price" support level = 1.7/0.02 = 85 sen

Current price is at 92 sen, about 10 % from 85 sen

So you can buy at 82, sell 89 or whichever the market gives you at a profit.

Strongest support range 70 - 76 sen which is 10 % below the "fair price."

Tuesday, May 26, 2009

Resorts and Genting Losing Steam

Monday, May 25, 2009

Petronas Dagangan Profit Falls To RM810m

Revenue, however, rose to RM24.37 billion from RM22.30 billion previously, on the back of higher average selling price during the first half of the calendar year, it said in a statement to Bursa Malaysia today.

It said profit for the next financial year, however, would be impacted by fluctuations in petroleum product costs following uncertainties in the international oil prices and the global economy. The marketing arm of Petroliam Nasional Bhd operates 900 service stations, of which four are hyper-stations and more than 570 are equipped with the retail convenience store, Kedai Mesra.

Sime Darby Q3 down 85%.

The company said its industrial and property divisions were recovering, but its plantation business faltered due to the drop in crude palm prices and lower production as a result of biological tree stress.

Sime Darby, valued at about US$11.8 billion, said January-March net profit fell to RM165.68 million from RM1.11 billion a year earlier.

IOI Corp, Malaysia’s No.2 palm oil producer, said its January-March net profit slumped 97 per cent on the fall in prices, weaker output and foreign currency losses.

Singapore-listed Wilmar earlier this month said net profit grew 11 per cent as higher refining and trading margins offset lower revenues, and said it was optimistic about sustained demand from China and India.

Malaysian palm oil firms are more vulnerable to falling CPO prices than Singapore rivals as they are mostly operating in the upstream industries that supply palm oil to refineries.

Resorts Real Rally

So I did a simple maths to estimate Resorts "fair price," based on dividend declared of 4 sen. Assuming Resorts recorded dividend yield of 3% and pay 4 sen twice a year, "fair price"= 8 sen/0.03 = 267. So fair price of Resorts is approx. RM2.67

Closing at RM2.80 today, it's just about 5% over fair price. I think Resorts will go higher given the liquidity in the rally. It's liquidity over the fundamentals in short term trading and scalping. Enjoy the ride on the coat-tails of the big boys who has the liquidity...

OSK rated Resorts a buy with TP RM3.25

Resorts World Bhd surged 8.1 per cent to RM2.79, the steepest gain since July 20, 2007, after OSK Research raised its rating amid speculation its parent, Asia’s biggest casino operator, may invest in a unit of MGM Mirage.

Genting Bhd, which owns 47 per cent of Resorts World, jumped 6.7 per cent to RM5.55

OSK upgraded Resorts World’s stock rating to “buy” and increased its target price to RM3.25 from RM2.58, saying were cheap valuation compared with Genting. Resorts World “had always traded at a 10 per cent to 20 per cent premium to Genting as it is indeed the group’s main earnings and cash-generative outfit,” OSK analyst Keith Wee said in a note to clients today.

Investing in MGM Grand Macau “could certainly pave the way for the group’s long-awaited entry into Macau’s gaming market,” he added.

US Dollar Index Falls 50%

Wednesday, May 20, 2009

Steel Sector Slipping

Looks like money is flowing out of steel and construction sectors.

Only Ann Joo, Southern Steel and Lion Ind is holding in the green.

KLCI is held up by Maybank, Sime, Axiata, IOI, Tenaga, KLK, PPB, PLUS, Astro and PBBank.

Tuesday, May 19, 2009

Money Flowing Into Plantation and Financial Sector

Financial Index up 2.3% led by Maybank

Someone highlighted to me that small plantation counter TDM paying gross dividend of 14 sen (net 10.5 sen), ex 23rd June- pay 21st July.

At share price of RM1.75 that's a neat 8%, better than ASM, ASW.

Mkt cap = RM380 m. Net profit = RM101 m. Shares Issued = 218 m.

Therefore EPS = 46 sen. Dvd = 14 sen.

Fundamentals: PE ratio = 4. NA = RM2.73

This is one buy and hold counter to place in your core portfolio. And sleep well.

Take the dividend year after year.

Compare this with my core holding of TH Plant, final dividend 7.5 sen, ex 6th May- paid 20th May

Mkt cap = RM 814 m. Net profit = RM83 m. Shares Issued = 487 m.

Therefore EPS = 17 sen. Dvd = 14 sen.

Fundamentals: PE ratio = 10. NA = RM 1.64

At current price of RM1.68, dividend yield = 14/168 = 8.3% gross

HS Plant. Final dvd 5 sen goes ex 1st June- pay15th June

Mkt cap = RM 1800 m. Net profit = RM130 m. Shares issued 800 m.

Therefore EPS = 16 sen. Dvd = 10 sen tax exempted.

Fundamentals: PE ratio = 14. NA = RM2.06

At current price of RM2.27, dividend yield (10/227) = 4.4% net

which is higher than bank FD

Classic Chart Pattern Predict Bad News Followed by Good News

Chart pattern suggests that the market will move lower over the next six weeks.

Chart pattern suggests that the market will move lower over the next six weeks.I received in my email an article by Rick Pendergraft pointing out the three levels of resistance that might keep S&P in check for next few months.

One of the striking thing on the chart is the symmetrical move from the neckline to the head and from the head back to the headline. Each of these moves lasted nine weeks. It doesn't have to be that well defined to fit as an inverse head and shoulders pattern but the formation is obvious.